President Trump Begins Tax Cut Promises

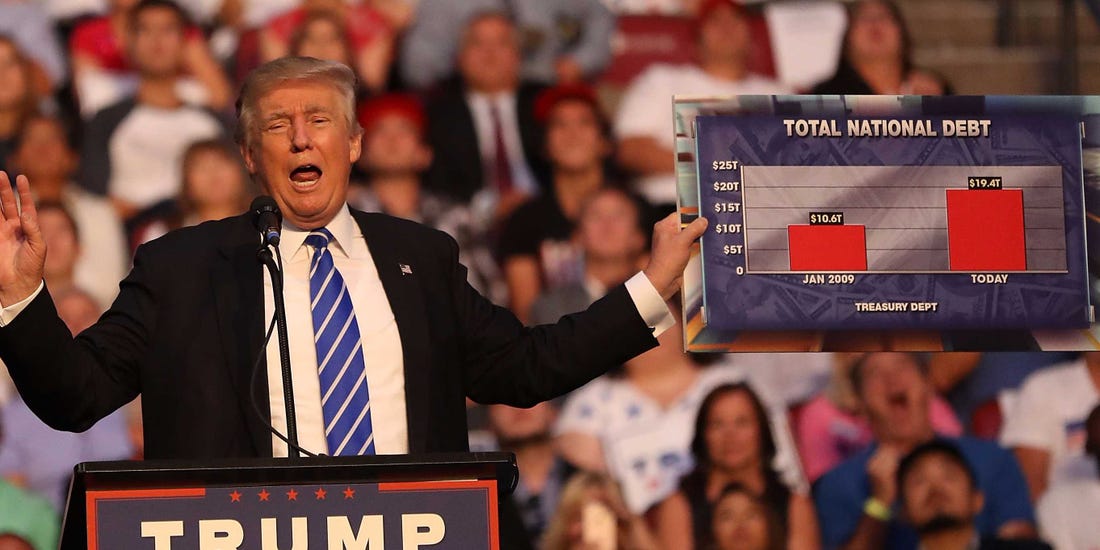

Trump Speech | Photo Credit Fox News

Trump Speech | Photo Credit Fox News

In Washington, President Trump has instructed his advisors to begin a 15 percent corporate tax cut, which will be unveiled this week. This means cutting the tax to 15 percent, down from 35 percent.

During his campaign, Trump referred to this general ideas as “maybe the biggest tax cut we’ve ever had,” but with everything else going on, he hasn’t begun to publically embrace this change since stepping into the Oval Office.

This new decision could create another showdown with Congress.

White House Begins Tax Plans

The White House | Photo Credit Huffington Post

The White House | Photo Credit Huffington Post

The New York Times reports:

“The White House is planning to formally roll out its tax plan on Wednesday, ending months of speculation about the president’s intentions for rewriting the tax code and following a prolonged period of confusion in which he and his top advisers sent mixed messages about what elements they favored and how the tax cut would be structured.”

“The people who described Mr. Trump’s corporate tax cut target, first reported by The Wall Street Journal on Monday, did so on the condition of anonymity because they were not authorized to discuss it before an official announcement.”

This 15 percent rate is much lower than what House Republicans original proposed in a tax cut blueprint developed by Speaker Paul Ryan, however the good news is the…

Tax Plan Will Pay For Itself

American Money | Photo Credit Flickr

American Money | Photo Credit Flickr

The Washington Post reports:

“Trump has pledged that the tax cut in total would be the largest in U.S. history, and his advisers have said that the economic growth it stimulates would make up for any shortfall in revenue. “The tax plan will pay for itself with economic growth,” Treasury Secretary Steven Mnuchin said Monday.”

“But any changes would have to be backed by Congress, and passing a sweeping tax cut plan that widens the deficit would be virtually impossible on Capitol Hill without bipartisan support, in the view of key players in both parties. Many Democrats have said they will not support such a plan, making Trump’s proposal a tough political sell from the start.”