Payment Increases

Photo Credit: dcurbanmoms.com

Photo Credit: dcurbanmoms.com

There are some important changes happening for social security recipients this year. From payment increases to higher earnings limits. We thought we would share them with you so you know how these changes might affect you and your family.

There have been several tweaks to the program this year that will result in a modest increase of 0.3%. For most recipients, this translates to an average monthly payment of $1,360 for single recipients and about $2,260 for married couples.

Benefits are adjusted to keep up with inflation and are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers.

There are also changes to the tax cap. In 2016, the maximum amount a person could earn and be taxed on was $118,500. Anything over this amount was not taxable by Social Security.

This amount has been increased to $127,700 for 2017. This increase means 12 million more people will contribute which will…

Strengthen the System

Photo Credit: pbs.org

Photo Credit: pbs.org

There is also good news for retirees who still want, or need, to work. In 2016, those under 65 who collected social security could only earn $!5, 720 without being penalized. That amount has been raised to $16, 920 this year.

The earnings increase is even higher for those who will turn 66 in 2017. The amount has increased $3,000 which raises the earning limit to $44,880 before penalties are imposed.

In addition to the earnings increase, there will be a reduction in benefits withheld for those who earn too much. For retirees 65 and under, there will be $1 in benefits withheld for every $2 earned over the limit.

For those who are age 66, it is lower at $1 withheld for every $3 earned. However, at age 66 and 2 months (full retirement age), you are no longer penalized for working and collecting benefits.

Even better, any benefits previously withheld, will be returned to you! For a great breakdown of how working may affect your benefits, you can download this pamphlet from the SSA.

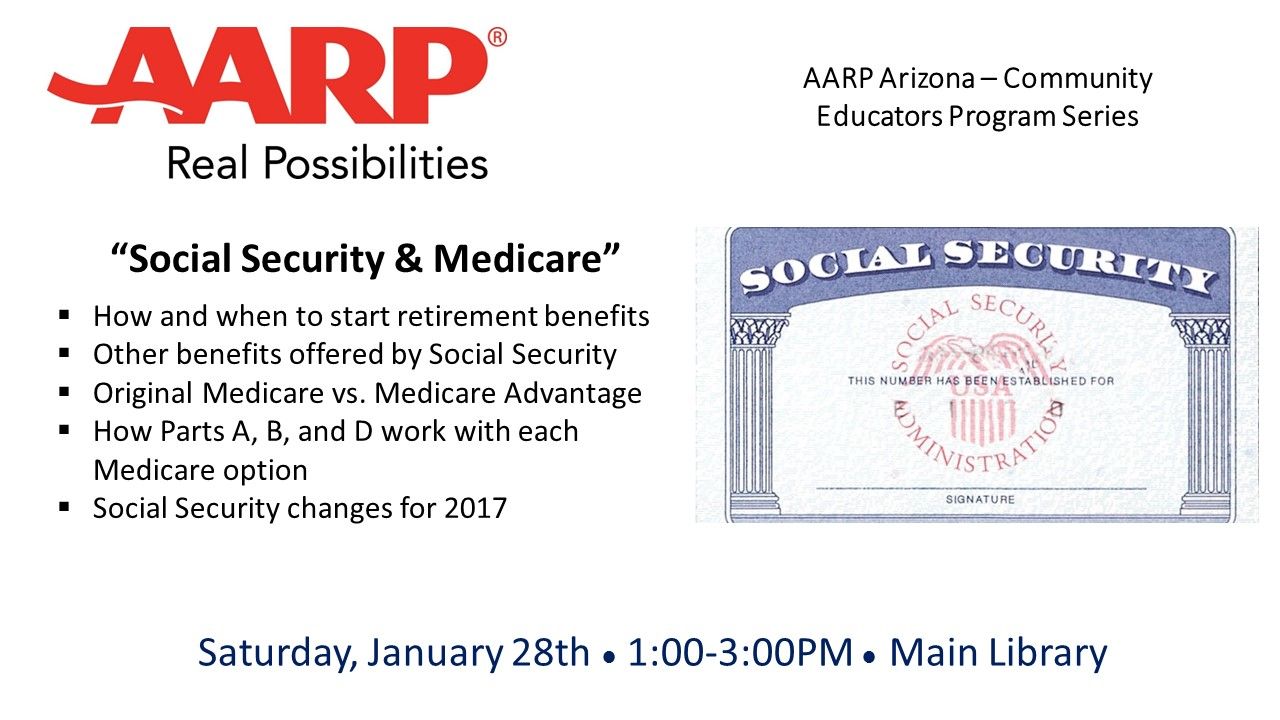

You also have the option to manage your benefits by creating a personalized account. Through your personal account, you can calculate potential future benefits and make sure your earnings are being calculated correctly.

Sponsored Links

Photo Credit: dcurbanmoms.com

Photo Credit: dcurbanmoms.com Photo Credit: pbs.org

Photo Credit: pbs.org

So the presumption of higher SS check amounts–payments to retirees is not being considered?

THat .3% didn’t mean a thing when they raise the medicare so it wipes out the COLA. Take some of the senate and house benefits away, repay the money stolen from social security for a failed obama care and .3% after 3 years is nothing ,not with rising cost of meds.out of pocket payments,housing and food.

what about our sos sec. checks will they increase? and whats the story about medicare that goes up more than raise of 2.00 whole thing sucks i DONT WANT TO HAVE TO WORK

Thank you President Trump

Not good enough! There needs to be a minimum base for Social Security that’s above the poverty level !

But it’s a start….just needs a bigger start!