Last night the Bridgestone Arena in Nashville, TN held as much country talent as one place can. The 2017 CMA Awards were a night to honor albums, artists, musicians, and songwriters. But of course, only one can win. And here they are!

photo from www.inquisitr.com

photo from www.inquisitr.com

Female Vocalist of the Year

This year had some heady competition for the Female Vocalist of the Year. Serious veteran Reba McEntire was one. (Not surprising given she’s won the award four times, and been nominated practically every year.) Other familiar faces were Miranda Lambert and Carrie Underwood.

Lambert had several other nominations this year, partly due to her major album release, The Weight of These Wings.

There were also a few newcomers to the group, however. Both Maren Morris and Kelsea Ballerini are relatively new to the scene (at least compared to their nominee counterparts). Both are in their 20s and young in their careers.

And the winner is Miranda Lambert!

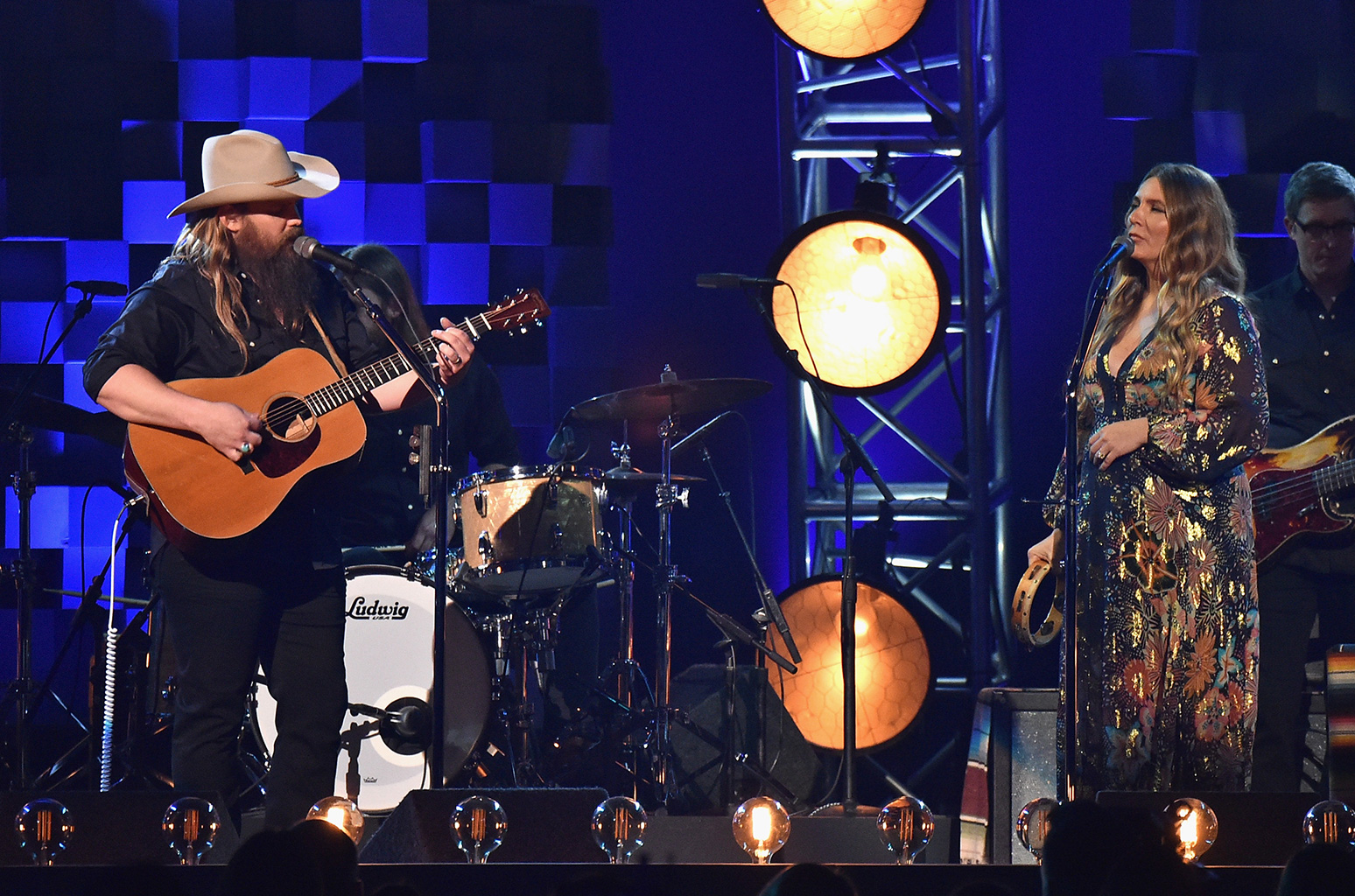

Chris Stapleton (photo from Billboard)

Chris Stapleton (photo from Billboard)

Male Vocalist of the Year

The field certainly wasn’t much lighter for the male nominees. However, there certainly wasn’t a veteran of McEntire’s status in the field.

Regardless, there were definitely some usual suspects, including Chris Stapleton, Keith Urban, Dierks Bentley. The other two nominees were Eric Church and Thomas Rhett.

Stapleton once again came into the show with several nominations, which seems to be common for him since his first CMA Awards just two years ago. Urban also carried multiple nominations.

And the winner is Chris Stapleton!

Entertainer of the Year

Perhaps the stiffest competition of this year was in the Entertainer of the Year Category. Garth Brooks, the reigning winner, was nominated again. The four other nominees were four country gents, Luke Bryan, Eric Church, Chris Stapleton, and Keith Urban.

And the winner is Garth Brooks! Looks like he gets to wear his crown another year!

Garth Brooks (photo from soundslikenashville.com)

Garth Brooks (photo from soundslikenashville.com)

Album of the Year

2017 saw some amazing country albums! The nominees this year were

- The Breaker, Little Big Town.

- From A Room: Volume 1, Chris Stapleton.

- Heart Break, Lady Antebellum

- The Nashville Sound, Jason Isbell and the 400 Unit

- The Weight of These Wings, Miranda Lambert

And the winner is Chris Stapleton, From A Room: Volume I! Luckily for Stapleton fans, the second volume is due out next year!

Single of the Year

The first award of the night was for single of the year. This year had some amazing singles released, but again, only one winner. The nominees were:

- “Better Man,” Little Big Town

- “Blue Ain’t Your Color,” Keith Urban

- “Body Like A Back Road,” Sam Hunt

- “Dirt On My Boots,” Jon Pardi

- “Tin Man,” Miranda Lambert

And the winner is “Blue Ain’t Your Color” by Keith Urban!

Jon Pardi (photo from Myrtle Beach Sun News)

Jon Pardi (photo from Myrtle Beach Sun News)

Other Awards

Song of the year went to Little Big Town for “Better Man.”

“Funny How Time Slips Away,” from Glen Campbell with Willie Nelson won Musical Event of the Year. Glen Campbell sadly passed away August 8 of this year, three months to the day before his last award.

Brothers Osborne was the Vocal Duo of the Year, while Jon Pardi took home the New Artist of the Year.

Vocal Group of the Year went to Little Big Town, and Brothers Osborne “It Ain’t My Fault” took home Music Video of the Year.

Last but not least, Musician of the Year was Mac McAnally (Guitar).

It was an amazing night celebrating country music! Here’s looking forward to 2018!