Want to have a great afternoon with your grandkids while babysitting? If you say yes, then here are a few things you can do to prevent boredom from striking in.

Credits: Adobe Stock

Credits: Adobe Stock

Scavenger Hunt

Nothing excites kids more than hunting for treasures. Kids have this unlimited source of energy. Instead of walking, they tend to run and jump all day long. Utilizing this energy is important to prevent kids from getting bored and cranky. When you organize a scavenger hunt, their attention is focused on one thing only – to look for clues and to find the coveted treasure.

Play Games

Hide and seek is another game that kids are good at. They can fit in any available space imaginable. If you want to make time fly, playing hide and seek works great. The best thing about this is that grandparents won’t actually have a hard time playing it.

Picnic, Picnic, Picnic

I know one family who loves to just go out on spontaneous picnics. They just spread their picnic blanket in their backyard and bring out a couple of sandwiches. Kids love all sorts of outdoor activities, even if it means just to sit back and relax while eating a sandwich in your own backyard.

Cooking

Cooking is a great time to spend with your grandkids. There is nothing kids love doing more than helping out with grown-up activities. As a grandparent, you can look for ways on how to enlist the help of your grandkids by letting them prepare some of the simple yet important ingredients. Kids will thrive in situations where they know that what they are doing is important. Baking cookies or any pastry is another way to stop boredom from settling in.

Bike-riding

Bicycle riding is another activity that both grandparents and kids can enjoy. The benefits of bike riding are limitless. It is not only a good outlet for kids’ energy but a great exercise for the grandparents. This is the time for the grandparents to share what they know about nature to their kids. They can stop occasionally to rest or to watch the sunset together. These are memories that will forever stay with your grandkids.

Gardening

Well, for kids they might see it as a back-breaking chore, but the moment they start gardening and are given important tasks, they will enjoy it immensely. This is also the best time to teach your grandkids important values of ‘weeding out’ bad habits and practices just like removing weeds from a garden plot.

Board Games

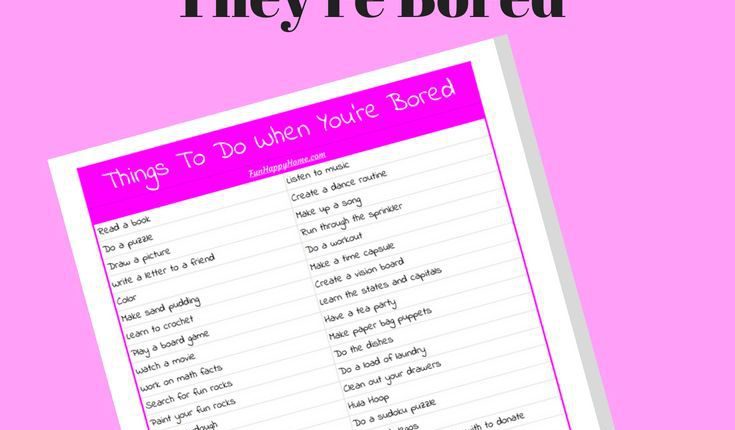

You can organize board or card games. At first, you can expect raised eyebrows, because let’s admit it, children nowadays no longer play board games. But have faith; board games are created to expel boredom in the first place.

It all boils down to how you spend time with your grandkids without spending money or gas, but taking advantage of what you already have. There are a lot of age-appropriate and simple activities that a grandparent can prepare or organize for grandkids without the help of video games, television, and the internet. You just need a little bit of creativity.